Table of Contents

While there are some nonprofit professionals who migrate to this world of charity from a for-profit organization, they are often faced with some major differences between the two industries right off the bat.

- For instance, no one owns nonprofit organizations. Even if someone founded it and sits on the board, they don’t have equity in the organization. They don’t have retained earnings or equity accounts. Meanwhile, for-profit companies may offer percentages or shares in the form of stocks.

- Another major difference is that for-profit companies sell goods or services to earn income. Meanwhile, nonprofits rely primarily on donations and grants. This makes it advantageous (and necessary) for nonprofits to establish a system of fund accounting.

One of the greatest differences between these types of organizations is in bookkeeping.

Bookkeeping for nonprofits is especially important because these organizations must remain accountable to those who provide funding. Supporters of these organizations want to know where their hard-earned money is going and the best way to explain this is through reports.

In this article, we’ll dive into bookkeeping for nonprofit organizations.

The financial record keeping for nonprofits must adhere to certain regulations and best practices. Let’s start at the beginning: Vocabulary terms you should be familiar with.

Important Nonprofit Bookkeeping Vocabulary

As an experienced nonprofit professional, you’ve probably run across these terms before in your reading and during work. But have you ever slowed down to really take them in? Taking a step back to better understand the vocabulary associated with bookkeeping for nonprofits can help you develop a better understanding of exactly what you need to accomplish.

Our ABCs of nonprofit bookkeeping include acronyms such as:

GAAP: GAAP stands for Generally Accepted Accounting Principles. It’s a set of standards for accounting reports. Reports that follow these principles are especially useful as a resource of cross-organizational comparisons due to their consistency in report components. GAAP standards are applicable for both nonprofit and for-profit organizations. Be aware that there are some components that will be applicable to only for-profit organizations and others that will only be applicable to nonprofits due to their inherent differences in accounting styles.

FASB: FASB stands for Financial Accounting Standards Board. This independent organization establishes and interprets the GAAP. They’re responsible for establishing reporting standards for nonprofit organizations and companies.

If you view reporting as a hierarchy, FASB reports fall higher on the spectrum than the GAAP reports. They follow the guidelines set by GAAP but are even more specialized.

AICPA: AICPA stands for American Institute of Certified Public Accountants. This organization provides standards and regulations for CPAs to follow. Similar to FASB standards, AICPA standards fall higher on the hierarchy and pull more weight in professional circles.

GASB: GASB stands for Government Accounting Standards Board. This board is similar to FASB in that they use and interpret GAAP to create accounting reporting standards for state and local governments.

Now that we’ve learned the ABCs of accounting, let’s dive a bit deeper into some other vocabulary you’ll likely run across.

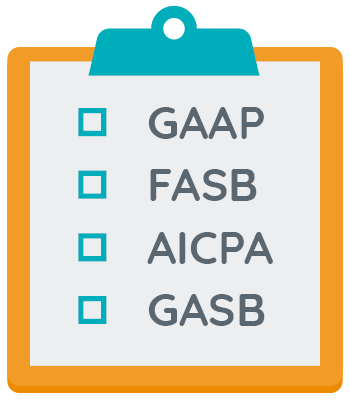

Cash vs. Accrual Accounting: Cash and accrual accounting are two different methods of recording transactions. If your organization uses cash basis accounting, you’ll record transactions when cash is received or spent. For instance, if you host a pledge campaign, you’d only record pledge money once it’s paid out.

Accrual accounting, in contrast, records expenses or revenue when they’re earned. Using the same pledge campaign example, an organization using accrual accounting would record these pledges as they come in. However, they may only record according to the average fulfillment rate rather than the pledge totals for more accurate results.

Financial Statement: It’s important to recognize the two different references associated with the term Financial Statement. The first is a general-purpose financial report used to communicate with the public outside of the organization. The second is a more detailed, internal report used to communicate with departments across the organization.

What statements and forms are most important to nonprofit bookkeeping?

The common statements and forms used for effective nonprofit bookkeeping are those that will thoroughly and effectively communicate the financial information for your nonprofit. Whether you’re communicating with other organizational departments, the public, or the government, using a proper statement or form with all the necessary components is key.

Be sure to look up the GAAP or FASB reporting standards for each statement or form you fill out. Consistency is key for proper comprehension of your target audience. They’ll know exactly where to look for the information they want to find.

So what are these forms? And what are they used for? Some of the common statements and forms you should be familiar with include the: statement of financial position, statement of activities, statement of functional expenses, statement of cash flows, and Form 990.

Statement of Financial Position

Your nonprofit’s statement of financial position is another name for your balance sheet. This is one of the primary financial statements used by nonprofits. Your statement of financial position provides a snapshot as to what your finances looked like during a certain period of time.

The statement records your organization’s assets, liabilities, and the difference between the two for a certain accounting period.

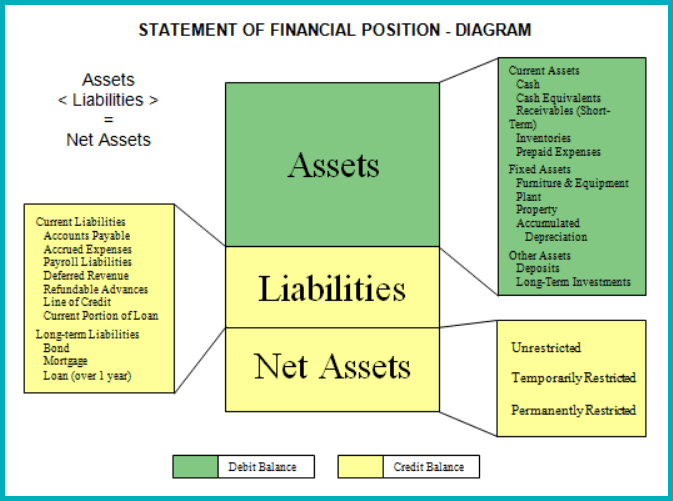

Nonprofit Accounting Basics provides an effective diagram explaining what the assets and liabilities encompass on your statement of financial position:

Your assets include elements like your nonprofit’s cash, inventories, furniture, property, deposits, and long-term investments. Meanwhile, liabilities include elements such as accounts payable, accrued expenses, deferred revenue, and line of credit.

This chart also covers your nonprofit’s net assets. Net assets are equivalent to the net worth of your nonprofit organization. GAAP calls for these net assets to be divvied and classified as unrestricted, temporarily restricted, and permanently restricted funds.

The goal of your statement of financial position is to accurately and effectively record bookkeeping information for nonprofits in order to best communicate to the board what is going on with the organization’s financial information.

Statement of Activities

Your nonprofit’s statement of activities goes by many names such as your income statement, budget report, profit/loss, income/expense, and others. No matter what your nonprofit calls this statement, it’s used for the same purpose.

Your statement of activities should show the changes in your organization’s net assets for a set period of time.

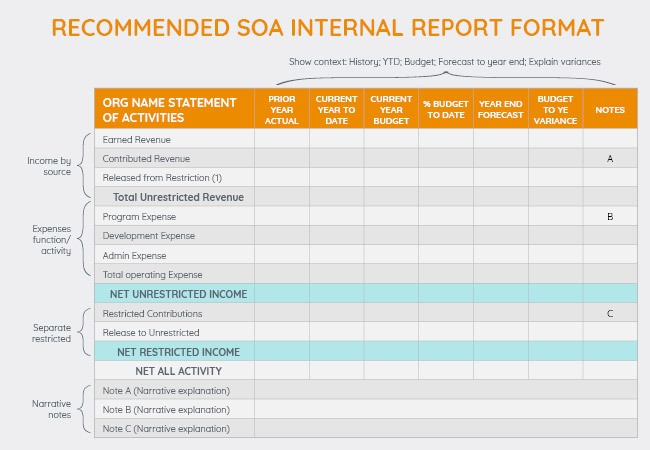

In general, try to keep your statement of activities to a maximum length of a single page. Narratives and explanations may carry onto additional pages, however. An ideal statement of activities will follow the following format:

The FASB Statement 117 requires nonprofits to report their changes in net assets based on their permanently restricted, temporarily restricted, or unrestricted funds. In the above example, you can see how restricted and unrestricted funds are classified in the spreadsheet.

Statement of Functional Expenses

The statement of functional expenses was once only required for health and welfare organizations, but the FASB now requires all nonprofits to report expenses by their function and nature.

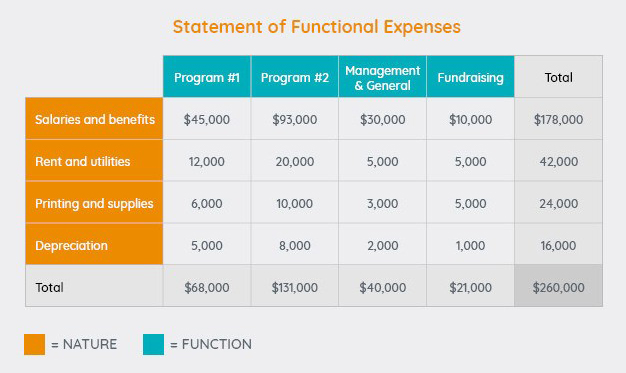

Your statement of functional expenses provides an in-depth look at your organization’s expenses and what those expenses were used for. The function of expenses refers to your organization’s programs, general and management expenses, and fundraising. Nature of an expense refers to the salaries, rent, supplies, depreciation, and similar types.

This matrix of data may look something like this:

Statements of functional expenses share some vital information with your annual Form 990, which also requires you to report expenses by function and nature.

Statement of Cash Flows

Your nonprofit’s statement of cash flows is used to report upon your organization’s change in its cash and cash equivalents during a set period of time. This statement divides net cash into three different sections:

- Cash from operating activities. This reports cash changes and flows associated with the operations of the organization.

- Cash from investing activities. This section reports the cash spent to purchase long-term assets and the amount received from the sale of valuable assets.

- Cash from financing activities. This section reports the cash flow received from borrowing money as well as repayment amounts.

An example of what this may look like is as follows:

This statement illustrates the flow of cash through the organization. It can help nonprofits better understand how much cash is available to pay various organizational expenses.

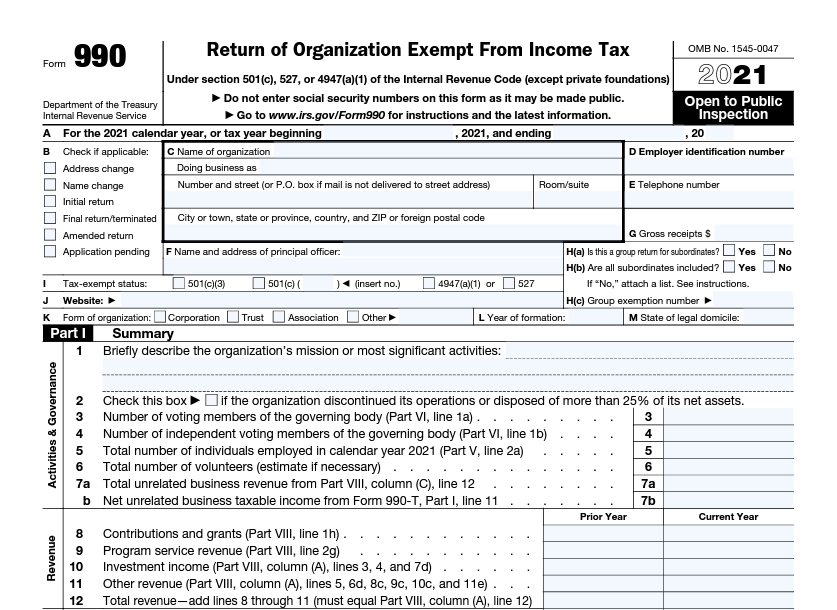

Form 990

Although your organization is exempt from paying taxes, so long as you’re registered as a 501(c)(3) organization, that doesn’t mean you can ignore tax season altogether. You’ll need to file a Form 990 annually in order to maintain your exempt status.

This form is due on the 15th day of the 5th month after your fiscal year ends. It covers information such as the revenue earned during that fiscal year and expenses. These expenses must be classified by function and nature just like your statement of functional expenses. The form looks something like this:

Keep in mind that your organization’s Form 990 is public domain. Don’t include any personal information such as social security numbers or other identifiable data on the form.

Using fund accounting software is an easy way to fill out your organization’s Form 990. This way you can ensure your information is correct and that you file on time every year.

Best practices for nonprofit bookkeeping

Now, let’s really dive into it some best practices!

Many organizations make bookkeeping for nonprofits more difficult than it really needs to be. When you implement a few simple tips and tricks to your strategies, nonprofit bookkeeping becomes much more manageable.

Create and maintain lines of communication between all departments.

Clear, effective communication is key for a well-run nonprofit organization. Without communication between various departments, how is your nonprofit board supposed to pass final decisions about next steps? How will your fundraising team know what goals to reach for?

Not only that, but different departments within nonprofits tend to bookkeep differently. For instance, your development department uses the cash-basis accounting while finance departments tend to use accrual. This can lead to discrepancies in records between departments.

Development and finance departments tend to be the closest in functionality, and therefore need to focus on streamlining communications with one another.

We recommend taking a few important steps to maintain clear lines of communication:

- Stay organized. Organization is the backbone of effective bookkeeping for nonprofits. When you have a complete and correct general ledger with all of the information you need for specific reports, you can feel comfortable pulling those reports whenever you have a need for them. The best way to accomplish this? Use effective nonprofit bookkeeping software to store data and automatically generate the reports you need.

- Set up regular meetings. During these meetings, the development and finance department will reconcile any differences in records. The finance department will also benefit from information about any major prospects, grants, and the types of giving the organization sees.

Make sure your nonprofit sets some important policies and guidelines to communicate important information between the two departments. For instance, informing the finance department about grant reporting requirements or pledge campaigns in a timely manner will help during audits.

Create internal controls for everything financial management.

Fraud is a topic that no one really wants to talk about. However, it’s a necessary topic to cover, especially in the nonprofit world. Our 2022 Nonprofit Research Study (which surveyed 400 nonprofit professionals) shows that 47% of nonprofits put a large amount of effort into preventing fraud at their organization, and 89% make at least some effort to prevent fraud.

Implementing internal controls and policies, your nonprofit can take the first step to protect itself against fraud.

- Why is this important? Fraud cases are burdensome and costly. According to the Association of Certified Fraud Examiners (CFE), a typical fraud case lasts 12 months before it’s detected and results in a median loss of $117,000 to an organization.

- CFE noted that the total amount of losses attributed to fraud was more than $3.6 billion, and the organization estimated that organizations lost 5% of their total revenue to fraud each year.

Internal controls act as a system of “checks and balances” for staff, board members, and outside vendors.

Start with a code of ethics for your organization as a part of your movement to keep your nonprofit bookkeeping records safe. Then, start creating internal controls that will help you monitor, enforce, and update these policies.

Maintain realistic operating expenses and fundraising forecasts.

Your nonprofit creates (or should create) an annual budget. However, we all have a tendency towards optimism in our budgeting. We want to do all sorts of important tasks with the money, so we’ll squeeze our expenses to try to fit everything in.

This tends to be an unrealistic approach to budgeting that will lead to overspending during the year.

When your organization implements effective bookkeeping for nonprofits, you’ll be able to better predict your operating and fundraising expenses for a more accurate budget in the future. Therefore, be sure your nonprofit bookkeeping software allows you to store past budgets with planned and real expenditures for future reference.

The same is true with fundraising forecasts. Nonprofits who track their past fundraising metrics are able to better predict their fundraising forecasts for the future, resulting in more effective budgeting.

Note: Don’t cut operating expenses too thin. While the overhead controversy explains how tempting it can be for nonprofits to cut these expenses as much as possible, be sure you keep in mind that you can’t grow without some overhead expenses.

Use accounting software designed for nonprofits by nonprofit accountants.

One of the best decisions you can make to help the finance department is investing in a nonprofit-specific accounting software solution.

Bookkeeping for nonprofits differs from that of for-profit organizations; so why would you want to use the same software for each of them? The unique needs of nonprofits require a specialized set of tools from accounting software.

Small organizations who are just getting started may be able to get away with a general accounting software solution. However, they’ll likely outgrow it incredibly quickly and start looking for a new software investment.

The best bookkeeping software for nonprofits will come with key features such as:

- FASB-ready reporting templates

- Internal controls to protect financial data

- Multi-year budget storage

- Human resources and payroll functions

MIP Fund Accounting® has 40 years of experience as the nation’s leading nonprofit, cloud-based SaaS fund accounting software that manages multiple funding streams, and helps your organization accomplish its mission.

Nonprofits are unique. Therefore, bookkeeping for nonprofits is also unique. Taking steps like educating yourself about the subject and investing in effective software will help your financial department become more and more effective.